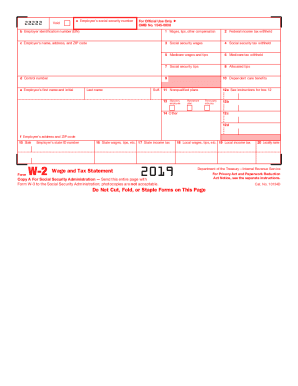

IRS 2350 2018 free printable template

Get, Create, Make and Sign IRS 2350

Editing IRS 2350 online

IRS 2350 Form Versions

How to fill out IRS 2350

How to fill out IRS 2350

Who needs IRS 2350?

Instructions and Help about IRS 2350

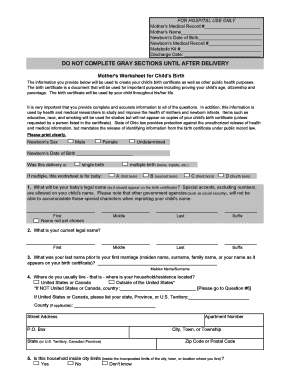

Hi guys its Michelle knight from little miss bookkeeping, and today I wanted to run through a form you might already be familiar with and that is how to complete your super form or your standard choice uh superannuation standard choice form, so it looks something like this it's something that you complete when you start a new job and as an accountant I do see these get completed incorrectly, so I thought it would be a good idea to just quickly run through um some details so if you're interested in learning more please keep watching [Applause] okay, so typically you will complete your uh super form when you commence um a new job, and you will generally be given this at the same time as your ten declaration, so I've created another video going through this um little baby um but an in your employer will give you these forms together, so you'll complete these both at the same time the reason why you will complete this form is so your employer can pay super into the right super fund now there are all different types of super funds different industry funds self-management for...

People Also Ask about

What is the IRS form for refund not received?

What is IRS Form 2350 used for?

What do I do if I don't receive a refund from the IRS?

What is form 3911 used for?

What is the difference between 4868 and 2350?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

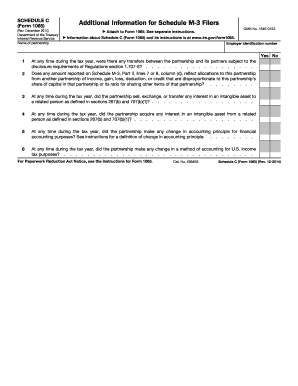

How can I edit IRS 2350 from Google Drive?

How can I send IRS 2350 for eSignature?

Can I sign the IRS 2350 electronically in Chrome?

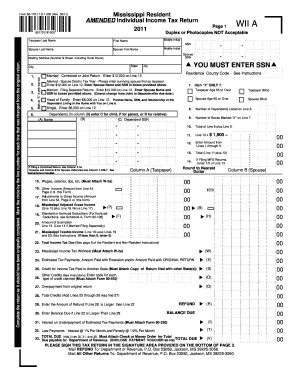

What is IRS 2350?

Who is required to file IRS 2350?

How to fill out IRS 2350?

What is the purpose of IRS 2350?

What information must be reported on IRS 2350?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.